Case Study

Details

Client

Neural Quant

Year

2022 - Present

Service

Intelligent Quantitative Finance

Brief

In this quantitative finance innovation project, I developed Neural Quant - an intelligent trading framework that combines machine learning, systematic quantitative strategies, and rigorous statistical analysis. The platform discovers and tests edges across global markets, tracking technology, AI, defense, aerospace firms, cryptocurrencies, and commodities. Successfully executed 1,000+ backtests and simulations while maintaining 24/7 market monitoring with real-time analytics and automated strategy refinement.

Details

The critical realization emerged that financial markets harbor hidden opportunities invisible to conventional analysts, opportunities that become apparent only through sophisticated quantitative methods and AI-driven pattern recognition.

Platform Architecture

Intelligent trading framework integrated with cross-asset market data feeds spanning equities, crypto, commodities, FX, and bonds. Neural networks, LLMs, and machine learning automation for research acceleration, combined with modular risk controls and systematic backtesting frameworks

Details

Seamlessly integrated quantitative research with live trading capabilities, from paper trading to real capital deployment with continuous performance tracking. 1,000+ backtests and simulations executed across strategies, building cumulative market insight. Expected returns (E[R] > 0) tracked and refined across tech, AI, crypto, and commodities with 24/7 continuous monitoring. Self-learning system that adapts in real time, expands intelligence, and pushes beyond traditional quantitative research boundaries.

Quantitative Research Foundation

My quantitative development work began by conducting extensive analysis of market inefficiencies and algorithmic opportunities across global financial markets, focusing on systematic edge discovery.

Body

I developed comprehensive quantitative solutions representing different segments of intelligent finance challenges. This helped me understand complex market dynamics and tailor algorithmic systems to meet specific trading and investment needs. I also mapped out quantitative workflows to identify critical signal touchpoints and opportunities for systematic strategy improvement through continuous backtesting and refinement.

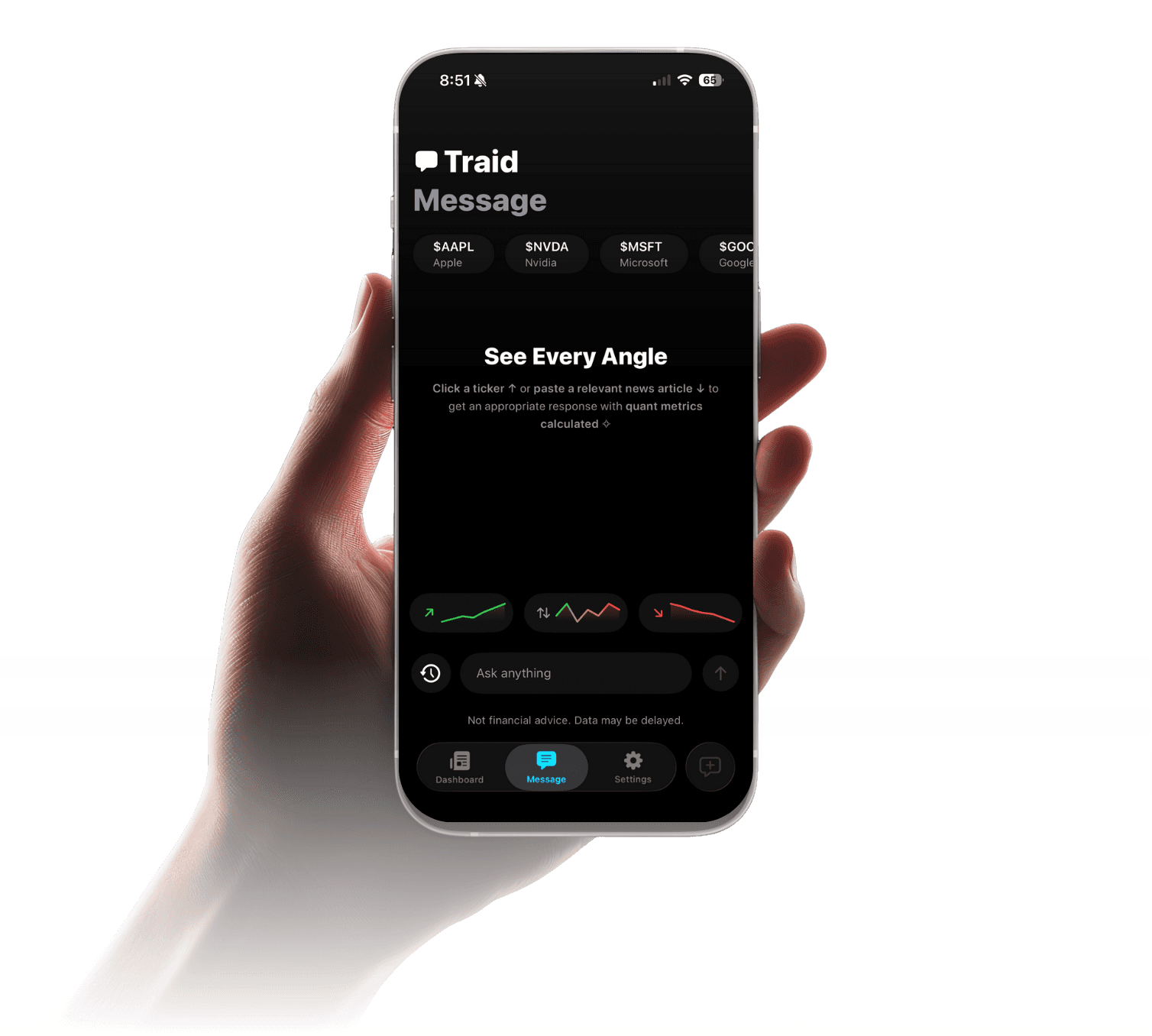

Traid

Related work